maine sales tax calculator

For State Use and Local Taxes use State and Local Sales Tax Calculator. The rates that appear on tax bills in Maine are generally denominated in millage rates.

Maine Sales Tax Table For 2022

The amount of tax is determined by two things.

. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Maine local counties cities and special taxation districts. The Maine State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Maine State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. Avalara provides supported pre-built integration.

Maine Property Tax Rates. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. Net Price is the tag price or list price before any sales taxes are applied.

Simply enter the costprice and the sales tax percentage. You can use our Maine Sales Tax Calculator to look up sales tax rates in Maine by address zip code. Maine Transfer Tax Calculator.

Ad Manage sales tax calculations and exemption compliance without leaving your ERP. In addition to taxes car purchases in Maine may be subject to other fees like registration title and plate fees. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase.

The state sales tax rate is 55 and Maine doesnt have local sales tax rates. After a few seconds you will be provided with a full breakdown of the tax you are paying. Maine collects a 55 state sales tax rate on the purchase of all vehicles.

To know what the current sales tax rate applies in your state ie. Maine has a 55 statewide sales tax rate and does not allow local governments to collect sales taxes. Enter the Amount you want to enquire about.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. This state sales tax also applies if you purchase the vehicle out of state. The age of the vehicle Manufacturers suggested retail price MSRP How is the excise tax calculated.

Sales and Gross Receipts Taxes in Maine amounts to 24 billion. If you have any questions please contact the MRS Sales Tax Division at 207 624-9693 or salestaxmainegov. You can always use Sales Tax calculator at the front page where you can modify percentages if you so wish.

That said some items like prepared food are taxed differently. Retailers can then file an amended return at a later date to reconcile the correct tax owed. In short if the vehicle is registered in the state of Maine then the Maine car sales tax of 550 will be applied.

15 - Maine Use Tax View Main Article. Choose the Sales Tax Rate from the drop-down list. Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Maine does not apply County Local or Special Sales Tax Rates tso the Total Sales Tax applied across the State of Maine is 55 you can calculate Sales Tax online using the Maine Sales Tax Calculator. For more accurate rates use the sales tax calculator.

For example if you purchase a new vehicle in Maine for 40000 then you will have to pay 550 of the purchase price as the state sales tax or 2200. Excise tax is calculated by multiplying the MSRP by the mill rate as shown below. Maine sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

Total Price is the final amount paid including sales tax. The goods news is that Maine sets its Sales Tax Rate as a flat rate across the State so although the Sales Tax Formula Still applies. Your employer withholds money to cover your Maine tax liability just like it.

Sales tax is not collected at the local city county or ZIP in Maine making it one of the easier states in which to manage sales tax collection filing and remittance. YEAR 1 0240 mill rate YEAR 2 0175 mill rate YEAR 3 0135 mill rate. The ME sales tax calculator has the option to include tax in the gross price as well as the amount to be added to net price.

Finally click on Calculate or not our calculator doesnt even require your action it automatically does it all. Input the amount and the sales tax rate select whether to include or exclude sales tax and the calculator will do the rest. The Maine Department of Revenue is responsible for publishing the latest Maine State.

Calculate a simple single sales tax and a total based on the entered tax percentage. Invoicing clients or selling to customers and need to know how much sales tax to charge. - NO COMMA For new vehicles this will be the amount on the dealers sticker not the amount you paid.

Maine Sales Tax Calculator Whenever you make a purchase at a licensed Maine retailer your sales tax will be automatically calculated and added to your bill. Enter your vehicle cost. Maine Sales Tax Calculator calculates the sales tax and final price for any Maine.

For example a home with an assessed value of 150000 and a mill rate of 20 20 of tax per 1000 of assessed value would pay 3000 in annual property taxes. Use our simple sales tax calculator to work out how much sales tax you should charge your clients. The state sales tax is among the lowest in the country and there are no additional local sales taxes collected throughout the state.

Maine Sales Tax Calculator. City Sales Tax Rates County Sales Tax Rates Maine sales tax details The Maine ME state sales tax rate is currently 55. The rates drop back on January 1st of each year.

To lookup the sales tax due on any purchase use our Maine sales tax calculator. Overview of Maine Taxes. A mill is the tax per thousand dollars in assessed value.

So whether you live in Maine or outside Maine but have nexus and sell to a customer there you would charge your customer the 55 sales tax rate on most transactions. Maine all you need is the simple calculator given above. You can find these fees further down on the page.

It is 4951 of the total taxes 49 billion raised in Maine. How are trade-ins taxed. Retailers who want to request a payment plan may also contact the MRS Compliance Division at 207 624-9595 or compliancetaxmainegov.

Do Maine vehicle taxes apply to trade-ins and rebates. Maine has a progressive tax system with the one of highest top marginal tax rates at 715.

How To Register For A Sales Tax Permit Taxjar

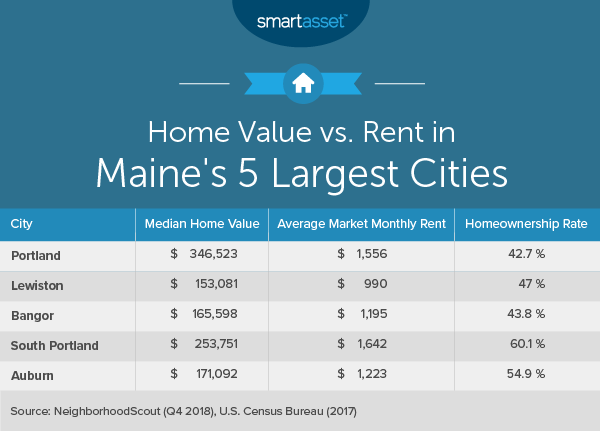

What Is The Cost Of Living In Maine Smartasset

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

Maine Sales Tax Information Sales Tax Rates And Deadlines

Maine Vehicle Sales Tax Fees Calculator

Maine Vehicle Sales Tax Fees Calculator

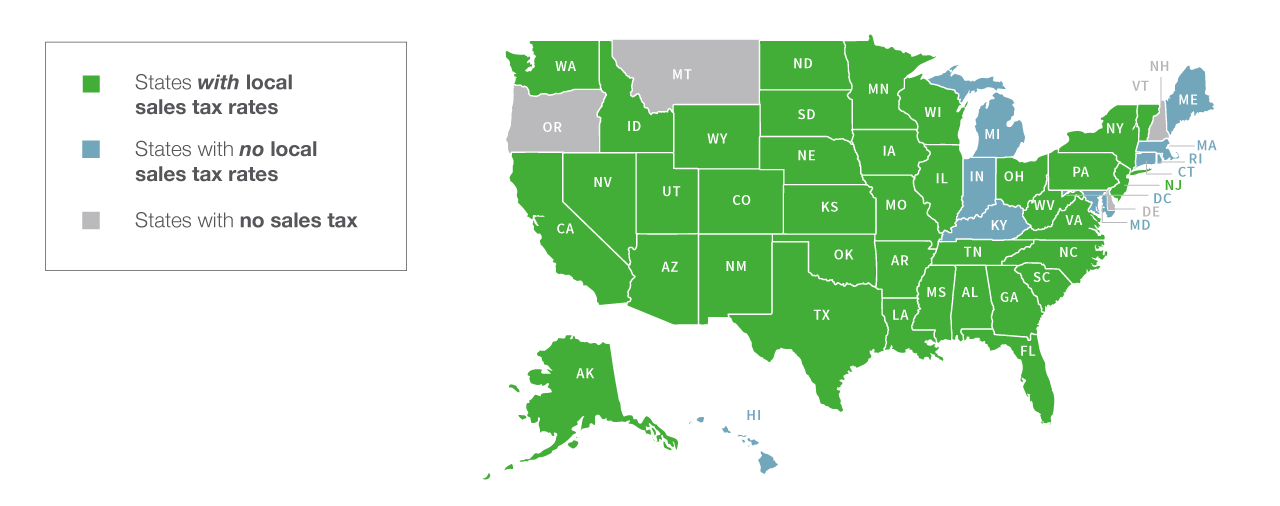

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Massachusetts Sales Tax Calculator Reverse Sales Dremployee

Maine Vehicle Sales Tax Fees Calculator

How To Charge Your Customers The Correct Sales Tax Rates

Maine Income Tax Calculator Smartasset

States With Highest And Lowest Sales Tax Rates

Maine Sales Tax Small Business Guide Truic

Maine Sales Tax Guide And Calculator 2022 Taxjar

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Item Price 85 Tax Rate 6 5 Sales Tax Calculator

How To Calculate Cannabis Taxes At Your Dispensary